A Guide About Accounts Preparation for all Your Business’s Financial Health Needs

Home / Guide about Accounts Preparation

Recent Blog

Subscribe to Newsletter

When the financial information of the company is presented in a clear and organised manner, it is accounts preparation.

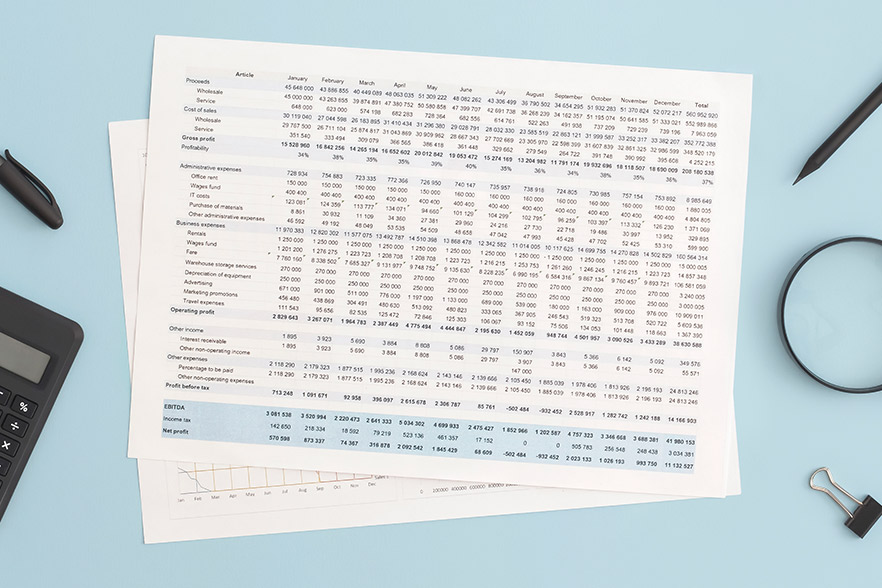

In the process of account preparation, the task is clear compiling and presenting a company’s financial information. There are many facets of accounts preparation, such as, the balance sheet, profit and loss statement, and cash flow statement. These are all financial records. A well-reputed accounting company, such as MMBA Accountants, can help a great deal to prepare the financial statements. Moreover, such financial records are significant to evaluate the financial health of a business. They make sure that you stay in the safe zone of regulatory compliance, are making informed decisions about business operations.

Businesses can track their financial transactions and can manager their expenses through accurate accounts preparation. It helps to comply with legal requirements. In this regard, limited companies must submit their statutory accounts to Companies House and HM Revenue & Customs (HMRC) to meet tax obligations— also, adding the corporation tax.

Table of Contents

Importance of Annual Accounts

Annual accounts are very important because they provide a comprehensive overview of a company’s financial performance and position. Moreover, such accounts are essential to assess their financial health and make informed decisions about future operations of businesses. Thus, preparing annual accounts makes sure that businesses maintain transparency with stakeholders (investors, creditors, and tax authorities).

Additionally, it is a legal requirement for all the limited companies in the UK to file the company’s annual accounts with Companies House, however, any failure to do so on time results in penalties and legal consequences.

Financial Statements

Financial statements are an important part of the accounts preparation process. The reason is that they provide valuable insights into the performance of a company and its financial position over a specific period of time. The main financial statements include

Contact MMBA Accountants for

understanding accounts preparation!

Call us Today

Balance Sheet

A balance sheet is a snapshot of what the company owns; and it also shows what the company owes at a specific point in time.

Profit and Loss Statement (Income Statement)

A profit and loss statement is a summary of revenues, expenses, and profit or loss over a financial year.

Cash Flow Statement

A record of cash inflows and outflows from operating, investing, and financing activities.

Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of three main sections:

Assets

Assets talk about the what the business owns. It includes: bank statements, inventory, and fixed assets

Liabilities

Liabilities are the debts of the company. In includes loans, accounts payable, and tax liabilities.

Equity

The residual interest in the company’s assets after deducting liabilities.The balance sheet helps business owners and investors to assess the financial health of a company and stability.

Accounting Records

Accounting records are very important, and more important is to maintain these records.

Nonetheless, maintaining accurate accounting records is essential for businesses to make sure that proper accounts preparation is streamlined properly. These records include:

- Financial statements

- Bank statements

- Invoices and receipts

- Payroll records

- Accounts payable and accounts receivable

- Loss account and expenses reports

By law, businesses must keep these records for a minimum of six years to comply with regulatory requirements.

Working with an Accountant

Working with an accountant is another important aspect of accounts preparation that cannot be overlooked. It streamlines the accounts preparation process. Furthermore, it makes sure that accuracy and compliance are not abandoned. All in all, chartered accountants provide professional services to help businesses with:

- To prepare the financial statements in accordance with accounting standards

- Filing corporation tax returns and statutory accounts

- Make sure that legal requirements and regulatory compliance are in check

- He advises on tax deductions and financial planning

An accountant can also assist with preparing the company tax return. This minimises the tax liabilities, and it also have an impact on optimising the business finances.

Filing Annual Accounts

Filing annual accounts is also important. Firstly, the companies have to file their annual accounts with Companies House within the specified timeframe. Also, another thing is about businesses accounts submission—they can submit their accounts online or by post. This makes sure that all financial data is accurate and complete. Lastly, filing late can result in penalties and legal consequences, so it means that timely submission is essential.

Notes and Disclosures

Notes and disclosures accompany financial statements. It also provides additional information about specific items. Moreover, they explain accounting principles used, financial records, and any contingent liabilities that are implied. Disclosures are the requirement by law and one must include them in statutory accounts to make sure transparency.

Best Practices for Accounts Preparation

Businesses should follow best practices to make effective accounts preparation, including:

- To keep accurate and up-to-date financial records

- Proper use of accounting software for efficient financial management

- Review of financial statements before filing

- To make compliance with accounting standards and legal requirements

Benefits of Accurate Accounts Preparation

Accurate accounts preparation provides several benefits, including:

- Improved financial decision-making

- Compliance with regulatory requirements

- Better financial health assessment

- Cost savings and efficiency

- Better business credibility and reputation

Businesses can gain valuable insights into their financial position by proper accounts preparation. Moreover, one can optimise tax returns, and improve overall financial performance.

Conclusion

Accounts preparation is a critical process for businesses to make accurate and compliant financial information possible. Moreover, it also involves to prepare financial statements, maintaining accounting records, and to file the accounts with Companies House. Thus, by following best practices and working with an accountant, accurate and compliant accounts preparation by businesses can be made possible. Lastly, this lead to improved financial decision-making and regulatory compliance.

FAQs About the Account Preparartion

What is accounts preparation, and why is it important?

Accounts preparation is the process in which compiling and organising a company’s financial report is carried out (includes, balance sheet, profit and loss statement, and cash flow statement). Moreover, when it comes to accurate financial tracking, or regulatory compliance, and better decision-making for a business’s financial health, it holds an eminent place.

How does accounts preparation improve a business’s financial performance?

An accounts preparation improves a business’s financial performance in following ways. Proper accounts preparation helps businesses track revenues, expenses, and business operations. Secondly, through this, businesses identify cost-saving opportunities and optimise their company’s performance—reviewing key reports like the auditor’s report and director’s report.

What role does a director’s report play in a company’s financial report?

A director’s report plays an important role in company’s financial report. It provides an overview of a company’s performance, and it highlights key financial activities, and plans for future growth. Secondly, it is a crucial part of statutory accounts, to help clients, investors, and regulators fully understand the company’s financial position and compliance with laws.

How does accounts preparation contribute to time saving for businesses?

Accounts preparation contributes to time saving for business in many ways. For example, accounting software and professional services for accounts preparation reduces manual errors and administrative workload. This leads to significant time saving.

What factors should a company consider when choosing an accountant?

A company must consider following factors, when a company chooses an accountant, they should look for experience in accounts preparation, his knowledge of tax regulations, and expertise in financial compliance. Moreover, he also makes sure that all the legal requirements and compliance requirements are met.